Acquisition project | Vamaship

Elevator Pitch

Vamaship is an online shipping aggregator.

The main product is a B2B SaaS platform where sellers (e-commerce websites or social sellers) can book a shipment. Logistics partners such as BlueDart and Delhivery, who find it difficult to deal with the long tail of shippers (i.e. businesses who deal in low volumes, typically less than 500 shipments a month), prefer a shipping aggregator. At the same time, as volumes are aggregated, Vamaship gets a price discount compared to the shipper trying to go directly to the logistics partner. Additionally, as a logistics aggregator, we serve more pin codes than any one of the partners.

Understand your Product

The B2B SaaS platform is mainly for sellers (e-com or social sellers), who can easily book their shipment. A seller does not have enough time to focus on logistics, as that is not the core of their business. By integrating with Vamaship with just a few clicks, users can semi-automate their shipping. Vamaship fetches their Shopify/Woocommerce/Amazon orders, and the seller can book their shipments through a single click.

Additionally, as a logistics aggregator, Vamaship can offer a price discount.

Understanding Core Value Proposition

Easy integration

Easy shipment booking & tracking

Reduced shipping prices

Good support

Reduced RTOs

Understanding the Users

As this is a B2B industry, the users are:

Decision makers: Logistics head/Founder (depends on scale)

Influencer: N/A

Blocker: On rare occasion, VCs have been known to favour ShipRocket

End user: Consumer buying products (mostly B2C, but there are a few B2B shipments as well)

Understanding your ICP

B2B Table:

Criteria | ICP1 | ICP2 |

|---|---|---|

Name | Ecom website | Social seller |

Company Size | 5-25 | 1-5 |

Location | pan India | pan India |

Funding Raised | 10 lakh - 10 cr | 10,000 |

Industry Domain | e-commerce | e-commerce |

Stage of the company | Early scaling | PMF |

Organization Structure | Logistics head reports to Owner | N/A |

Decision Maker | Logistics head | Owner |

Decision Blocker | VC | N/A |

Frequency of use case | Daily | Twice a week |

Products used in workplace | Shopify, Woocommerce, Whatsapp | Social media, Youtube, whatsapp |

Organisational Goals | Cost, delivery rate | Revenue |

Preferred Outreach Channels | email, calls | Social networks, calls |

Conversion Time | 4 weeks | 1 day |

GMV | 20k - 200L per month | 200 - 20k per month |

Growth of company | High | Low |

Motivation | Find a convenient logistics partner with a large pincode coverage (they also look for cheaper options and are concerned about service quality) | Find an economical logistics partner |

Organization Influence | High | High |

Tools Utilized in workspace | Computers, printers, mobile phones | Mobile phones, printers |

Decision Time | 4 weeks | 1 week |

| | |

ICP prioritization table

Criteria | ICP 1 - Ecom websites | ICP 2 - social sellers |

|---|---|---|

Adoption Curve | High | High |

Appetite to Pay | High | Low |

Frequency of Use Case | High | Medium |

Distribution Potential | Low | High |

TAM | Rs 1000 bn | Rs 10 bn |

Therefore, we prioritise Ecom websites over social sellers, while maintaining a low involvement in the latter

Understand Market

Competitor analysis

Factors | Competitor 1: ShipRocket | Competitor 2: Shipway | Competitor 3: NimbusPost | Competitor 4: Shipyaari |

|---|---|---|---|---|

What is the core problem being solved by them? | Convenient and economical one stop logistics shop | Convenient and economical shipping with a focus on quality | Convenient and economical one stop logistics shop | Convenient and economical shipping |

What are the products/features/services being offered? | Shipping & tracking, integrations, warehousing, influencer marketing | Shipping & tracking integrations | Shipping & tracking, integrations, warehousing | Shipping & tracking integrations |

Who are the users? | Small to medium enterprises, social sellers | Small to medium enterprises, social sellers | Small to medium enterprises, social sellers | Small to medium enterprises, social sellers |

GTM Strategy | | |||

What channels do they use? | Blogs, Events, Tech integrations | Case studies, Direct outreach | Blogs, Direct outreach | Social media marketing, Blogs, Direct outreach |

What pricing model do they operate on? | per-shipment cost, subscription models | per-shipment cost | per-shipment cost, subscription models | per-shipment cost, subscription models |

How have they raised funding? | Venture capital | Angel investors | Venture capital | Angel investors |

Brand Positioning | e-com enablement platform (all in one) (price first) | Shipping enablement platform (quality first) | e-com enablement platform (all in one) | Shipping enablement platform (quality first) |

UX Evaluation | Overwhelming for a new user, but otherwise good. Customer centric, Simple flows, Aesthetic, | Simple UX focusing on core shipping | Customer centric UX with modern aesthetics. | Simple UX focusing on core shipping |

What is your product’s Right to Win? | Without a KAM, Shiprocket's responsiveness is subpar. There is a niche in the <5000 shipments per month category, where this is usually true. | The products are comparable right now | Deeper focus on shipping means that RTO rates are lower with Vamaship | The products are comparable right now |

What can you learn from them? | Their marketing channels (Blogs & Events) may be beneficial. | Case studies can be beneficial, esp to highlight impact of quality on overall logistics cost | All in one platforms have an advantage | N/A |

Calculating market size

TAM = Total no. of potential customers x Average Revenue Per Customer (ARPU)

SAM = TAM x Target Market Segment (percentage of the total market)

SOM = SAM x Market Penetration/Share

TAM = 6 million x 166k revenue per customer per year = Rs 1000 billion

SAM = 1000 billion x 2.5% = Rs 25,000 cr

SOM = 25,000 cr x 2.5% = Rs 625 cr

Designing Acquisition Channel

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Organic | Low | Low | High | Low | Medium |

Paid Ads | High | High | Low (pitches are ready as we've been experimenting already) | High | High |

Referral Program | High (Planning on higher rewards) | Low | Low (most elements already in place) | High | High |

Product Integration | Low | Low | Medium (our tech team is experienced at this) | High | Medium |

Content Loops | Low | Medium | High | Low | Medium |

During Early scaling phase, Effort and Speed are the most important as they yield experiment results quickly. Paid ads and referrals are the main acquisition channels to focus on. The 3rd broad channel would be product integration.

Detailing your Acquisition Channel

Paid Ads

Step 1 →Define the CAC: LTV ratio. If your product has a healthy CAC:LTV ratio, proceed with paid ads.

Step 2 → What digital channels will you work with?

Step 3 → What will be your audience selection & creative strategy? (What you build in ideal customer profile should reflect here)

Step 4→ Design the Ad Campaign

Step 5 → Frame the Ad Budget

CAC = Rs 1000, LTV = Rs 3500. Paid ads are suitable as LTV > 3 * CAC

Previously we tried google display ads, but without a filter mechanism to stop bad leads. As a result, we reduced google ads spend. Even today, however, google ads are not performing as well.

Instagram ads were tried out for some time, but it seems there's no meaningful results. There has not been any user coming via instagram, though we've received a few impressions, likes, shares and traffic. Feels like an ATL campaign. We'll be trying out some niche targeting ("social selling" interest, for instance) - if it doesn't work, we plan to kill the channel.

New channels we're experimenting on: Shopify and Facebook ads. Additionally, while the traffic here does not reflect it, we also get orders from Woocommerce (via product integration). However, we currently do not advertise there, so it's been picked as an experimental channel. Shopify ads are so expensive though! LTV and CAC need to be monitored rigorously here.

Similarweb results:

Domain | Relevance | Cross-visitation |

|---|---|---|

Shopify | 100 | 25.00 % |

95 | 22.22 % | |

94 | 26.67 % | |

gmail | 89 | 25.00 % |

80 | 27.27 % |

Audience selection:

Audience selection on Insta/Facebook is based on interests rather than demographics. As such, "Social selling", "Shopify", "Woocommerce", etc are the target interests (in India).

Creative strategy

Position as the best in the industry for reducing RTOs (best in service quality). We have recent case-studies of reducing RTO rate by 66% through NDR flows.

Ad campaign design

Shopify ads:

Experiment with category ads (15 days) (both Orders & Shipping, and Shipping solutions) for visibility (currently we're below the fold on the category page)

Instagram ads: Boost instagram posts to relevant audiences (creatives that have worked for us in the past: Same day shipping (Mumbai only), Reduced COD rates.

Facebook ads (to be started): Using same creative as for Instagram

Google search ads: Continue with existing keywords

Budget for experimentation:

Product Integration

Step 1 → Understand does your product fit in?

Step 2 →Draw a possible flow of how the product will look like inside the integration.

Step 3 → Create a plan of multiple integrations that you could do.

Organic intent for Vamaship begins when a seller sets up their outlet. Currently, there are product integrations with Woocommerce, Unicommerce, Amazon, Wix, Instamojo, EasyEcom. With some of these platforms, the order booking, tracking, etc happens on partner page itself. With the rest, the seller has to visit the Vamaship page to perform minimal click action for each activity (single click for order booking, single click per weight dispute, etc)

Untapped markets are: OpenCart, Magento, BigCommerce, Zoho Commerce, PrestaShop, Bikayi, Ecwid, Indiamart. B2B is deprioritised as that's not our ICP. Ecwid and OpenCart are top priority for integrations. Integrations will be similar to what already exists.

Platform | Estimated no of sellers | B2C or B2B |

|---|---|---|

Ecwid | 900,000+ | B2C |

OpenCart | 340,000+ | B2C |

PrestaShop | 300,000+ | B2C |

Magento | 250,000+ | B2C |

BigCommerce | 60,000+ | B2C, B2B |

Zoho Commerce | 50,000+ | B2C |

Bikayi | 15,000+ | B2C |

IndiaMART | 150,000+ | B2B |

Referral Program/Partner Program

Step 1 → Flesh out the referral/partner program

Step 2 → Draw raw frames on a piece of paper to get the gist.

Vamaship uses a wallet system. As such, platform currency is credits (any promo credits cannot be redeemed to cash). Already, there is a referral program in place that offers the referrer a 1% commission on all revenue coming from their referees. There is a location in the portal where they can invite new users, track their progress in booking shipments, and thus track earnings.

However, this referral program has not seen much traction. The reasons:

1. There is no benefit for the referee

2. As such, there is a social risk for the referrer.

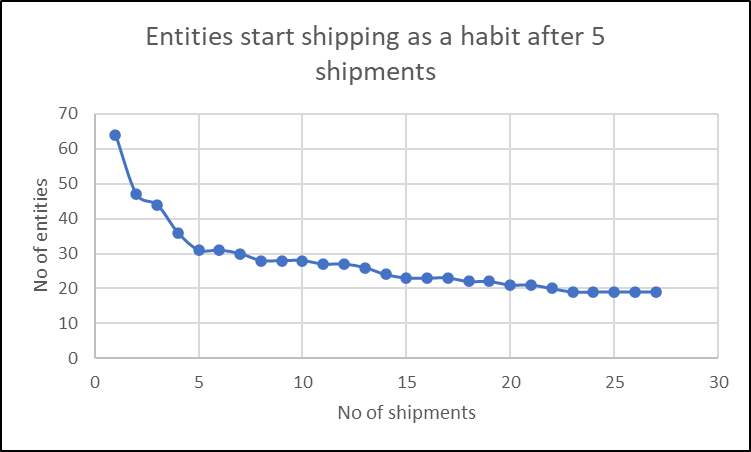

To solve for this, the plan is to give out credits in a phased manner. A referee's registration does not earn any credits for either side - this is to control for bad leads. GST verification ensures that there is minimal possibility for gaming the system. The referee gets the reward first, when they recharge their wallet with Rs 100 (reward = Rs 100 credit). At the 5th shipment, the referee gets bonus 150 credits (which usually covers for the first 5 shipments) which can be used for further shipments. The referrer also gets 250 credits at this stage. At the 25th shipment, the referee gets a much bigger bonus (750 credits, which usually covers for 15 more shipments). Naturally, the referrer still continues to get their commission as before. The selection of 5 and 25 shipments is explained in the below graph.

The only real concern here is that this may be too little of an incentive. Overall, the CAC for the best referee would come to just 1250 (1000 for referee, 250 for referrer). The LTV for larger shippers is significantly higher than for the average - which is Rs 3500.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.